Yesterday (29 Jul 2021), Bioventus and Misonix jointly announced an M&A. This deal is particularly significant in the advanced wound care (AWC) space for three reasons:

- The combined entity will be a “new” relatively large advanced wound care player (though similar to Misonix pre-deal, not necessarily with AWC as its sole focus).

- This is also part of a trend whereby companies (including mega-sized ones) have been realizing that to focus on wound healing is not only a huge opportunity, but also a space they may already be playing in without even being fully aware of it.

- M&A consolidation in the AWC space resumes, after an inorganic growth hibernation period, mostly related to Covid-19 uncertainty.

I’ll end this post by highlighting the key questions that I think the combined Bioventus-Misonix entity will need to carefully consider, which will drive their success in AWC (if they choose to make that space a focus for their growth) in the years ahead.

The potential creation of a new large AWC player?

On yesterday’s joint conference call, Bioventus CEO Ken Reali highlighted the potential for cross-pollination between the customers and care settings of the respective companies. He also cited significant diversity and scale across a range of care settings, geographies, and therapeutic areas…with leading technologies and specialized sales forces, serving a $15B total addressable market across the hospital, ambulatory surgical center, and office care settings.” He also pointed to orthopedics, lower extremity, and neurosurgery as key focus areas that will be served by the combined entity, as well as the ability to service new customers and realize cost synergies.

Bioventus’ core solutions and markets are largely focused on orthobiologics, and include HA (hyaluronic acid) for osteoarthrtitis, ultrasound bone growth / fracture treatment and rehab, non-pharmaceutical nerve pain relief, and others.

Misonix has regenerative medicine cellular and tissue product (CTP) solutions for wound and related indications, with the traditional core of its portfolio being its neXus ultrasonic platform. neXus (the instrument attachments are BoneScalpel, SonicOne and SonaStar) is used across multiple surgical and wound indications–mostly cutting / removing bone, tumor, nonviable soft tissue, and other ortho-plastics needs. More recently, they also added Sequel for external fixation.

On the joint call, Misonix CEO Stavros Vizirgianakis noted, “We believe we can enable new proprietary procedural solutions with the Bioventus portfolio,” and also spoke to the ability of Bioventus to accelerate Misonix’s international growth.

Integra Lifesciences, Organogenesis, Smith & Nephew, and Wright Medical (acquired by Stryker in late 2020) are illustrative examples of firms who have in recent years begun to increasingly blur the lines between advanced wound care / tissue regeneration and orthobiologics / orthopaedic hardware / sports medicine. On this point, it is important to note:

- There exist differences in approach depending on whether the “core” of the company is embedded in AWC / tissue regeneration, branching out to the ortho / sports med world, as opposed to the other way around.

- Typically, such companies still maintain separate commercial teams–in many cases all the way up to the senior management level, highlighting how tricky it can be to leverage wound care and ortho-plastics / foot and ankle call point synergies without neglecting the vast number of other specialties and decision makers involved in wound healing.

- These include: internal medicine, endocrinology, vascular, and nursing–as well as the often neglected yet critical administrative / managerial decision makers that are responsible for everything from clinical outcomes management, to clinical-operational flow, to reimbursement, to staffing / competencies, and in many cases full P&L responsibility of the program.

- The most successful companies who leverage AWC / tissue regeneration competencies to drive ortho-plastics / ortho-biologics results (and vice versa) have developed competencies and allocated resources to address all of the above.

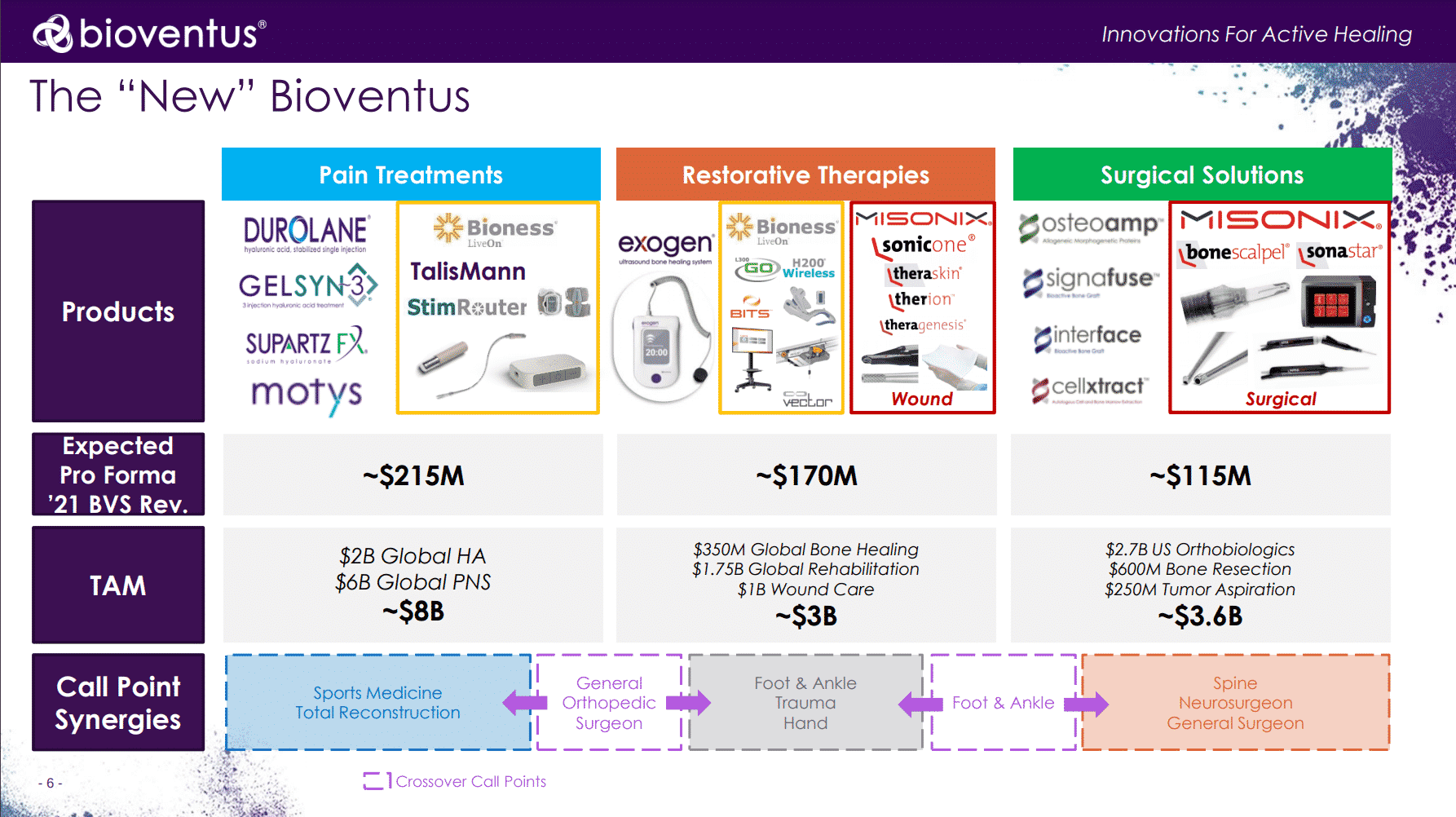

“The ‘New’ Bioventus” as presented on yesterday’s call is below:

While Misonix had been organized by surgical (~54% of revenue) and wound (~46% of revenue) divisions, the combined entity will be structured as follows:

- Pain Treatments: Comprised of Bioventus and Bioness (acquired in Mar 2021) existing product lines

- Restorative Therapies: Biovenuts and Bioness bone rehab, together with Misonix soft tissue debridement and CTP portfolio; This is where wound care will sit as well.

- Surgical Solutions: Bioventus bone grafting products, together with Misonix’s bone cutting solutions, as well as the the Misonix neXus console / control unit itself.

Broadly speaking, the proposed new structure makes sense. Indeed, Bioventus’ primary objective is and should be to maximize their stakeholder value and results overall–not necessarily to become a top global wound care player. Yet with their expected $170M 2021 revenue within the combined Restorative Therapies business unit, that is a non-trivial part of the AWC market–even if they expect it to make up just 34% of their total 2021 revenue. Should AWC become a priority, it may benefit from additional refocus and structuring, together with any future inorganic growth ambitions. But for an initial post-deal structure, it indeed strikes a reasonable balance between wound care and the more traditional segments.

Trend: Medtech firms “bleeding” into wound care, whether intentionally or unintentionally

We need to appreciate that most companies miscalculate–or perhaps it’s more fair to use the term “oversimplify” the AWC medtech market. Depending on the source, you may see the TAM (total addressable market) for AWC listed in the $2 to $50B range. Generally speaking, I think $5 to 15B is about right, but this really depends on the specific context and analysis being considered.

But to be clear: Any company involved in the creation, resection, repair, implant, infection management, perfusion, protection, stimulation, closure, and/or support of most tissue types, is to some extent involved in the business of wound healing.

Whether resecting a tumor, performing reconstructive surgery, postpartum care, or placing a stoma, orthopaedic fixator, or vascular access port, when clinicians and medtech solutions “touch” (physically or figuratively) one or more of the phases of healing, they are intentionally or unintentionally involved int he advanced wound care space. If you’re looking to further deepen your understanding of this point, It’s covered in greater depth in a previous article (“Investing in Advanced Wound Care? Avoid These 3 Costly Mistakes“).

J&J’s Ethicon, long known for leading in multiple categories from sutures to surgical instruments, has developed an evolved strategic narrative around what it calls, “surgical healing,” part of its “wound closure and healing” business.

This distinction is important: It implies differentiation not only what happens inside the OR or Emergency Department (i.e. the important yet brief hemostasis phase of healing). Rather, they and others seek to impact and differentiate how their products facilitate and prevent complications in the days, weeks, months, and years following the wounding event (i.e. inflammatory, granulation, epitheliazation, and remodeling/maturation phases of healing as well).

This strategic imperative was unveiled in their June 2021 video below:

Having established this: Is it constructive to simply label half of the medtech industry as “wound care” just because solutions are contribute to the above situations? Probably not. Though doing so could have significant healthcare economics implications.

However, understanding that there are virtually no “woundologists” with extensive training and focus in wound healing, means that anyone who creates, resects, repairs, implants, etc. is involved in wound care has important implications for the commercialization of such technologies.

Should medtech firms focus on wounds in particular settings (i.e. OR, wound clinic, home care, etc.)?

Should they put their resources on particular traditional specialists, such as foot and ankle, plastics, vascular, or oncological surgeons?

Should they focus on particular clinical and financial outcomes throughout the continuum, and if so, should they try to “own” specific wound types (i.e. diabetic foot ulcers, abdominal surgical wounds, pressure injuries, etc.)?

Unfortunately, for all too many executives and investors playing in the advanced wound care space–especially those who have deep experience in other medtech/biotech sectors but are newer to AWC, this is where they get burned.

Many innocently assume that the channel segmentation, market access, and customer decision making mechanisms largely follow the same patterns they experienced across vascular, oncology, orthopedics, rheumatology, obstetrics, radiology, or whatever therapeutic areas their background is in.

For firms like Bioventus and others for whom “the business of tissue healing” is now a material part of their business, the upside is huge. But it’s equally critical for firms newer to wound care avoid assuming that decision making and growth drivers will follow the same model as their legacy business lines as well.

Continuation of advanced wound care M&A consolidation post-Covid

A secondary reason this deal is notable is that it continues the M&A consolidation and integrations trend this industry has seen in recent years. This is a point on which most of the members of our executive panel at the last live EWMA conference pre-pandemic agreed on as well.

Certainly, the past 18 months has been somewhat of a hibernation period due to Covid-19. Most global medtech companies did a lot of strategic planning, but generally took a “wait and see” approach in terms of pulling the trigger on deals.

Understandably, not knowing for how long and to what extent the ability to execute in the field (healthcare settings) would be impacted was an important consideration taken by senior management.

Likewise, keep in mind that the advanced wound care products space is still dominated by a relative handful of large international players, counterbalanced by hundreds of startups and small firms. There exist comparatively few mid-sized players with wound care traction, and of those that are (were), they are often attractive M&A targets from larger global brands.

Some examples of this AWC trend from recent years include:

- Urgo Medical’s acquisition of SteadMed Medical (2018)

- Smith & Nephew’s acquisition of Osiris Therapeutics (2019)

- Misonix’s acquisition of SolSys Medical (2019)

Misonix, though not exclusively a wound care firm, was indeed one of just a few remaining mid-sized firms with a considerable wound care focus. If the trend of the past few years winds down, it will likely be mostly driven by a lack of attractive deal flow that meets the large companies’ criteria, rather than their lack of appetite for inorganic growth.

Key questions and implications to consider

It is very clear that the combined Bioventus-Misonix entity does not intend to “put all its eggs” in the advanced wound care basket, nor was that the case pre-merger. In fact, it seems that although there are some very clear synergies in areas like spine, expanding the platform technologies to new areas is at least as much–if not more of–a strategic driver of the deal than solely digging in to the current business.

As the Bioventus management team closes the deal and begins to integrate the entities, these are five of the key AWC questions that should be considered carefully:

- How to best focus on the “synergistic” call points without distracting or diluting sales effectiveness: OR vs Ortho / foot and ankle surgeon vs the follow up care (specialty clinic, etc)?

- To what extent might Bioventus focus on acute wounds and related conditions vs stay with sports med and spine? Or expand into DFU and other chronic wounds?

- How can we avoid similar fallout that befell 3M after its acquisition of Acelity (KCI-Systagenix), resulting in a significant exodus of key employees, evaporation of commercial-operational competencies, and a massive destruction of shareholder value?

- How might they capitalize on bundled reimbursement and other payment models that combine multiple portfolio therapies and other assets, including at risk models for particular conditions whose healing outcome can be improved by the full portfolio?

- What is the best way to capitalize on OUS–and especially emerging markets–opportunities for the combined entity, where AWC firms traditionally struggle to drive growth relative to other therapeutic areas despite the massive need and growth opportunities?

The definitive M&A agreement values Misonix at $518M, and is expected to close in Q4 2021.

Contact us to discuss your unique wound care business situation.

Download our free Definitive Wound Care Investment and Partnership Due Diligence Checklist.

Most importantly, don’t get hit with bad wound care business decisions.